Payment, Promos & Gift Vouchers

I have a question about VAT

Europe

Outside of Europe

Requesting a VAT invoice

Requesting a commercial invoice

Ordering from Europe?

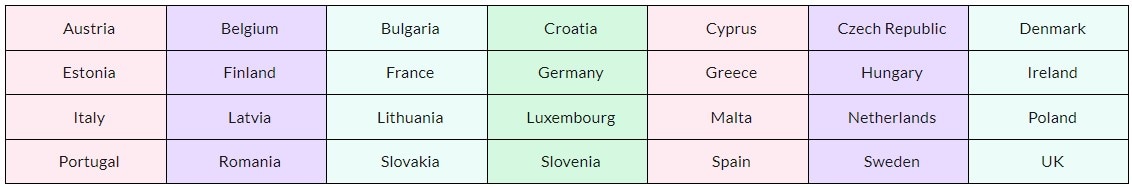

VAT is included in all our prices if you’re from one of the below countries:

Ordering from Norway?

Most international orders containing individual items under 3000 NOK will now be taxable at checkout at the appropriate rate of Norwegian VAT (25% for most products).

If your order is more than 3000 NOK, you may be liable for customs and import tax at the border. The VAT on these items will not be collected by ASOS at checkout. This should be managed automatically but if you are charged for an order 3000 NOK or below, please keep a proof of payment and get in touch with our Customer Care team who will arrange a refund of these charges.

Ordering outside of Europe?

VAT is not included in our prices for customers outside of the EU and UK.

Need a VAT invoice?

We’re only able to provide you with a VAT invoice if:

- Your order's billing address matches both your payment card's and your company’s billing address

- Your order was successful

- Your order has been already delivered to you

- Your whole order hasn't been returned and fully refunded (otherwise there’s no VAT due)

- Your order wasn’t a gift voucher purchase

If your order meets the above requirements and you need a VAT invoice, please contact our Customer Care Team with your VAT number and the order number(s) and we’ll look into this for you.

If your VAT number is correct and we haven’t been able to validate it, please contact your tax administration as they may need to update your address.

Need a commercial invoice?

If you need a Commercial invoice, please get in touch with our Customer Care Team and we'll arrange for one to be sent to you.